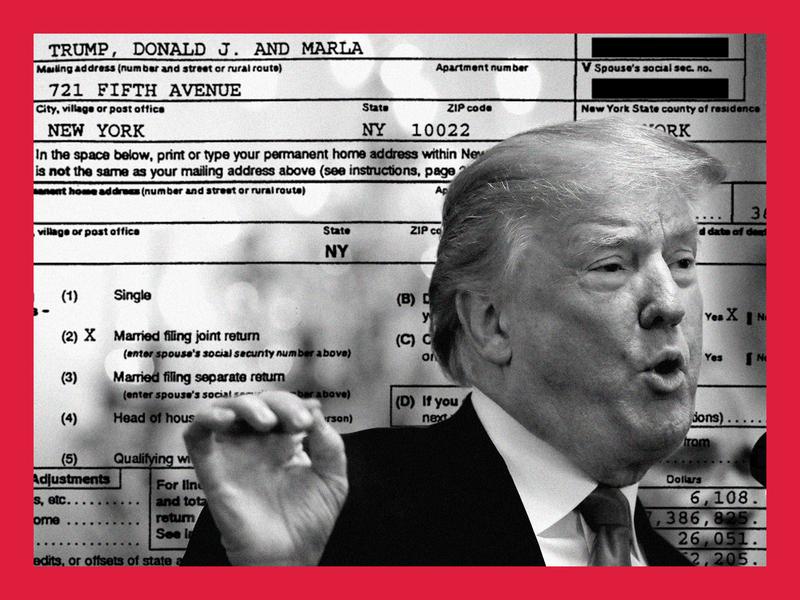

The main tax committee in the House voted Tuesday night to release six years of tax returns belonging to former President Trump as part of an investigation into the presidential audit program at the IRS. The vote was 24-16 and fell along party lines, with Democrats voting in favor and Republicans voting against.

The returns include six years of personal returns as well as returns for eight of Trump’s businesses. They’ll be released within a few days following redactions, committee members said Tuesday.

Reports from the Ways and Means Committee about the IRS’s presidential audit program as well as from the Joint Committee on Taxation (JCT) on the content of the tax returns have already been released.

Here’s what we know from their reports and from what lawmakers have been saying. The IRS didn’t audit Trump in 2017 or 2018 and Democrats want to know why

The IRS has a mandatory audit program for sitting presidents, but didn’t audit Trump until more than two years after he assumed the presidency. Trump filed two tax returns in 2017 and one in 2018, but only received his first audit while he was in office in 2019.

“There were no audits in a timely manner,” Ways and Means Committee chair Richard Neal (D-Mass.) said Tuesday.

“Once [committee] staff went to visit the IRS, once staff had a chance to go to some of the … locations that are within the jurisdictions of the IRS, they quickly concluded that in fact the audit did not occur,” he said.

Senate Finance Committee chair Ron Wyden said in a Wednesday statement that the “IRS was asleep at the wheel.”

“The presidential audit program is broken. There is no justification for the failure to conduct the required presidential audits until a congressional inquiry was made. I have additional questions about the extent to which resource issues or fear of political retaliation from the White House contributed to lapses here,” he said.

Trump’s two audit-free years may be part of the reason that no audits of the president were concluded during his time in office and that those started during the latter part of his term have yet to be finished. Tax experts say complex audits usually take several years.

“Not surprising,” Steve Rosenthal, an analyst with the Tax Policy Center who has testified to Congress about Trump’s tax returns, said in an interview about those audits remaining incomplete. “The IRS takes years to finish complicated audits.”

The presidential audit program is an IRS policy outlined in the agency’s regulatory manual, not a federal law. Neal showed off legislation he was introducing Tuesday evening to turn the policy into a law, but the future of that proposal is uncertain since the House is about to flip from Democratic to Republican control. The IRS started auditing Trump on the same day that Neal asked for Trump’s tax returns

Trump was selected for examination by the IRS on April 3, 2019, the same day that Neal wrote a letter to the then-commissioner of the IRS, Charles Rettig, asking for Trump’s tax returns.

That’s according to a letter from the IRS to Trump and his wife Melania, published online by Ways and Means Democrat Don Beyer (D-Va.) on Tuesday evening, parts of which were redacted.

“On April 3, 2019, Ways and Means Committee Chairman Richard Neal wrote the IRS to request Trump’s tax returns as part of our Committee’s oversight of the IRS’ mandatory audit of presidential tax returns. On the same day, the IRS initiated its first audit of Donald Trump’s tax returns,” Beyer wrote.

Other Democrats raised the alarm on Tuesday about this.

“In the case of the Trump years, there was only one time when the mandatory audit was triggered and that was when chairman Neal wrote a letter,” Ways and Means Democrat Judy Chu (Calif.) said during a press conference on Wednesday.

“There is something clearly wrong here,” Chu said. Trump paid $0 in tax in his last year in office

Trump’s tax liability fluctuated wildly in the years his returns were reviewed by the Ways and Means Committee and by the JCT.

The JCT found that Trump paid nothing in tax in 2020, $558,000 in tax in 2019, $5.3 million in tax in 2018 and nothing again in 2017.

His taxable income in these years was also a roller coaster ride. Trump had $0 in taxable income in 2020, $3 million in taxable income in 2019, $23 million in 2018 and $0 again in 2017.

These ups and downs were made possible by the strategic distribution of business losses, which soak up income levels and with them tax liability, tax experts say.

In 2015, Trump reported $105 million in business losses left over from more than $700 million in losses reported in 2009, according to Rosenthal.

These were distributed over the years that the JCT performed its examinations of Trump’s returns. For example, in 2015 Trump wrote down a $76 million loss in his “other income” category to wind up at $30 million in the hole.

This accounting trick resulted in a taxable income of $0 and a tax liability of $0 for that year.

“Trump paid nothing in taxes for years and years. How does he do that? Through losses. By using losses as a sheltering device,” Rosenthal said.

“Donald Trump’s tax returns exemplify the shortcomings of our tax code,” Wyden said Wednesday. “These are issues much bigger than Donald Trump. Trump’s returns likely look similar to those of many other wealthy tax cheats—hundreds of partnership interests, highly-questionable deductions, and debts that can be shifted around to wipe out tax liabilities.”

“Donald Trump had big deductions, big credits, and big losses—but seldom a big tax bill,” Ways and Means Committee member Lloyd Doggett (D-Texas) said in a statement Tuesday. “Trump claimed tens of millions of dollars in losses and credits without the type of substantiation an ordinary taxpayer would likely provide.” Trump was making his money through investments, not businesses

The JCT report shows that Trump’s real estate ventures and other businesses consistently lost money and were written down as losses, and that most of his actual income was coming through interest earned on his investments.

For 2020, Trump made more than $10.6 million in taxable interest. The same year, he reported a $15 million loss from his rental real estate properties and other ventures structured as S-corporations, partnerships and similar pass-through entities.

His total income for that year was a $4.7 million loss.

2019 tells much the same story. Trump reported $11.3 million made from interest and $16.5 million in losses incurred from his real estate businesses and other companies. His capital gains from that year totaled $9.26 million, putting him in the black for a total of $4.4 million.

That put his tax liability for that year into positive territory, at over $558,000.

The pattern of interest income reported as a net gain with business income reported as a net loss holds throughout the returns for the years reported to the Ways and Means Committee. Republicans say the release of Trump’s tax returns is a “political weapon”

Republicans have been saying that publishing Trump’s tax returns should be considered a new precedent, and some commentators are reading a threat of direct retaliation into it as Republicans prepare to take over the Ways and Means Committee in the new Congress. Biden administration releases doses of flu medicine from national stockpile Schumer says Senate could pass $1.7T funding package as early as Wednesday

“Ways and Means Republicans could come out and say, ‘You guys started it. This is both-sides-ism.’ And so they’re going to ask for the tax return information on Hunter Biden and Joe Biden and whoever else they want to embarrass,” Rosenthal said in an interview.

Ways and Means Republican leader Kevin Brady (Texas) said he didn’t want to speculate about what Republican control would mean for the committee in the next Congress, but he did mention tax returns on Wednesday in the context of the upcoming Congress.

“I won’t speculate on what the next Congress and this committee will focus on related to tax returns,” he said.